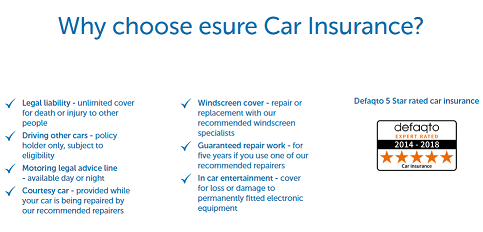

Purchase a Defaqto five-star rated car insurance policy, make savings thanks to our great esure cashback deals and have your motoring needs met by the services you will receive. As well as access to a 24/7 accident helpline, the cover includes a courtesy car as standard when you use one of their recommended repairers, while any work carried out by a recommended repairer will be guaranteed for five years.

Drivers will also receive unlimited legal liability cover for death or injury to other people, windscreen cover, access to a motoring legal advice line and cover for loss or damage to permanently fitted electronic equipment. Esure will, subject to eligibility, also insure the policyholder for driving other cars.

Multicar Cover

If you and a partner live at the same address and have two or more cars between you, you could save save money by insuring them on an esure multicar policy. As well as getting up to 10% off each additional policy, there are a range of other benefits you can enjoy too. The fact that they will match your no claim discount means that if you have a higher no claim discount bonus with one care, they will match it to the other policy, though any resulting increase will be restricted to the number of years the driver has held a full UK license.

There is also no need to worry if your partner's insurance is not up for renewal as, so long as their details do not change, they can give you a quote and guarantee it for up to six months. Also, if a claim is made on one policy, it will not affect the no claim discount on the other as they are kept separate.

ENTER

ENTER