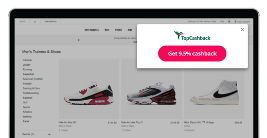

When you make a purchase from a retailer featured on TopCashback after clicking through from our site, the retailer will give us a commission for sending you to their website. We share this commission with you when you earn money, which we call 'cashback' and is actually paid by the retailer. Then, we'll make your cashback 'payable' for you to withdraw and spend.