Whether you’re a new driver or your insurance is coming up for renewal, insuring our cars can be an expensive game.

It’s against the law to drive a car without being insured, which means you can’t avoid paying for insurance if you drive a vehicle in any capacity. However, that doesn’t mean you need to pay more than necessary for your car cover, especially during a cost of living crisis.

If you’re keen to discover how to get cheap car insurance, you’re in the right place. Our handy guide is packed full of tips and tricks that you can try yourself to see if they reduce your premium. Whether that’s taking an advanced driving course, installing a black box or changing where you park your car overnight, there are plenty of small things you can try that might make a big difference.

The information contained within this article is for editorial purposes only and is a general guide and description of the products listed above. Nothing in this article should be relied on as financial advice.

There may be other products available not listed in this article which may be more suitable for your personal needs.

Understanding your options

Before you start comparing car insurance deals, you need to be clear on the different types of insurance cover available to you.

As well as understanding where to go to compare quotes, it’s also important to be clued up on all the different ways you can be insured, from fully comprehensive annual policies to pay-as-you-go schemes.

1. Get to know the different types of cover

There are three different levels of standard car insurance, with each level offering varying degrees of protection.

It’s very important you understand the difference between third party, third party, fire and theft, and comprehensive cover before you commit to any insurance agreement.

Third party:

As the most basic level of cover, third party car insurance is the minimum legal requirement for UK drivers. You’ll be covered for any damage caused to someone else’s car or property, as well as any injuries caused to someone else. You won’t be covered for any damage to your own car or any injuries you personally suffer.

Third party, fire and theft:

Third party, fire and theft cover gives you all the cover or third party insurance, but you’ll also be able to claim for fire damage, theft or attempted theft of your own vehicle. If you’re involved in a road accident that’s your own fault, you won’t be covered for damage caused to your vehicle or any injuries you suffer (although any injuries caused to passengers in your car will be covered).

Comprehensive:

Fully comprehensive cover is the highest level of insurance available. Unlike third party insurance, comprehensive cover will pay out for damage to your own vehicle, even if the accident was your own fault. You’ll also be covered for damage to the other party’s property or vehicle, as well as any injury suffered by you or any other people involved in the accident.

While you might assume that the most generous level of cover would be the most expensive, this isn’t always the case. With so many personal factors affecting your quote, you may find that comprehensive car insurance costs you less than basic third party cover.

When you’re browsing insurance quotes, it’s worth considering all three of the main car insurance types, just in case higher coverage is more affordable. Opting for fully comprehensive car insurance could also make you more appealing in the eyes of insurers as you may be classed as lower risk if they deem you to be more responsible.

2. Use multiple comparison sites for your research

Nearly everybody has some level of choice when it comes to the car insurance policy they go for, so it’s always wise to compare quotes in order to weigh up your options before committing to anything.

The premiums you’re offered will depend on your personal circumstances and potential risk factors, which include your age and driving history.

Having a look at a couple of different price comparison sites is a great way to get a ballpark figure of what your insurance may cost.

While you could just check one comparison site, the results are likely to be limited for two reasons. Firstly, some insurers will only appear on certain comparison sites, so only checking one site will reduce your options.

Secondly, comparison sites are able to negotiate their own exclusive rates with insurers, so an insurance policy on one site may be cheaper or more expensive than the same deal on another comparison site.

Make sure you double-check any quote you’re interested in on the insurer’s own site, just in case there are any discrepancies.

You should also bear in mind that not everyone will find the best deal with a standard provider. If you have a modified car or you fit into a high-risk group, you might want to consider looking at specialist insurers too.

3. Use TopCashback’s car insurance comparison tool

Speaking of using a range of sources, TopCashback Compare is an insurance comparison tool that allows you to quickly skim through a wide range of car insurance quotes from different providers.

Powered by Confused.com, TopCashback Compare rewards you with up to £40* cashback when you take out your car insurance policy from our list of quotes.

Even if you don’t end up using our comparison tool, you can earn cashback when you book your insurance premium through a comparison site, or directly with a provider, as long as you shop via TopCashback.

So, how does it work?

All you have to do is click through to the insurer’s website directly from their quote in our Compare results. Every brand featured on TopCashback pays us a commission for sending you to their site, and we give you 100% of that commission as cashback in your TopCashback account.

*Cashback correct at the time of writing.

We secured this exclusive offer, but our content stays unbiased.

Spend £15+ at eBay, Amazon, ASOS or any of 5,000+ brands to get £15 back

It's really simple: our site takes just 30 seconds when you buy online.

You do the shopping, we'll track your purchase, and then you'll get cashback in your account to withdraw to your bank or as a gift card.

Here's how to get your £15 offer;

- Click: Click the green button

- Join: Create an account

- Shop: Browse brands on our site

- Buy: Click Get Cashback then make a purchase

- Enjoy: We'll add £15 to your account once we track your purchase

How does TopCashback benefit? We make money when you buy from supported brands, which allows us to offer cashback with no hidden fees.

4. Don’t assume auto-renewal is your best option

There are Financial Conduct Authority (FCA) rules in place preventing insurers from quoting higher premiums for existing customers when they renew than they’d quote new customers. However, auto-renewal can still be unnecessarily costly.

So, just as you’d cast your net wide as a new driver looking at your first quotes, you’ll want to keep your options open when renewing your car insurance too.

With that said, this doesn’t mean you have to switch if you find a better deal. You could always go back to your current insurer and make them aware of the quote you’ve found elsewhere. They may match the price or offer you an even better price, which would mean you don’t have to worry about switching after all.

5. Make sure you renew your car insurance at the optimum time

When it comes to choosing the optimum time to renew your car insurance, there’s a very clear sweet spot.

Generally speaking, premiums increase in price the closer you get to your renewal date. Part of the thinking behind this is that drivers who leave renewing until the last minute are deemed to be more high-risk and less responsible overall.

Although it’s not an exact science, and prices will vary from person to person, Money Saving Expert reckon they’ve found the cheapest time for insurance renewal. They say the best time to find a cheap car insurance policy is around 20–26 days before the start date of your new policy.

Any earlier than 28 days before your policy is due to start and you may find the price starts to creep back up.

6. Don’t drive all that often? Consider pay-as-you-go insurance

According to RAC, people who drive less than 6,000 miles per year are likely to be overpaying for their car insurance.

If you’re a low-mileage driver who doesn’t tend to travel long distances, you could save money if you opt for pay-as-you-go insurance instead of an annual policy. With a pay-as-you-go policy, what you pay will depend on how long you’re on the road and how many miles you drive.

For example, RAC’s Pay By Mile insurance is a monthly rolling subscription. You’ll have a set fee to pay monthly, which will cover your car while it’s parked, plus a premium for each mile you drive in that month (starting from around 4p per mile). Your mileage is measured via a tag that you self-install, and you can track how many miles you’ve done using their mobile app.

7. Consider getting a black box fitted

Black box insurance involves getting a small telematics device installed in your vehicle that monitors how safe your driving is. These are particularly popular with young drivers, who might get stung by higher premiums due to being judged to be higher risk by insurers. Black boxes also make your car easier to track down if it gets stolen.

A telematics policy can mean you pay less for your insurance, but only if you actually are a responsible, low-risk driver. If you often accelerate too quickly or brake suddenly, you’ll run the risk of increasing the price of your premium, because the box will monitor everything.

They’re not for everyone, but this could be something to consider if you think you’re a better driver than insurance companies assume you to be based on factors like your age.

8. Insure multiple cars on one policy to get a discount

A multi-car insurance policy could save you money if you have more than one car in your household that needs cover. The usual factors will come into play here, so if one of you has lots of points on your license or is a new or younger driver, a multi-car policy might actually cost more.

You won’t find a multi-car discount if you’re looking on a comparison site, which means a little more research is required. Go directly to the provider’s own website to see what discounts they offer. To be sure you’re getting a good deal, you’ll then need to check the prices you find against the individual premiums that come up on your comparison site search.

If you already have a multi-car policy, don’t assume you’re definitely getting the cheapest price. When it’s time to renew, it’s worth doing a quick check to see if two separate policies could be cheaper. It’s probably unlikely, but certainly not impossible.

9. Can you save money by bundling your vehicle and home insurance together?

Just as you can cover multiple vehicles on one policy, you might be able to insure your car and home on the same plan. This is an option available to both homeowners and renters, as you can combine car insurance with either home insurance or contents insurance.

With Admiral MultiCover insurance, you can add all of your immediate family’s vehicles and houses and get a MultiCover discount on each one — you don’t even have to all live at the same address.

There are other providers who offer discounts when existing customers take out new policies with them, including Direct Line, Aviva and Churchill. As they’ll be kept as separate policies, they’ll have different renewal dates, but you’ll get an existing member discount for each one you add.

Tips that might unlock cheaper car insurance premiums

So, you’ve now had a chance to compare car insurance types and check out what a range of different insurance companies can offer you. The next task is to weigh up the effects of variable factors on your quote. Keep the following things in mind when comparing any quotes your search brings up.

10. Pay annually rather than monthly

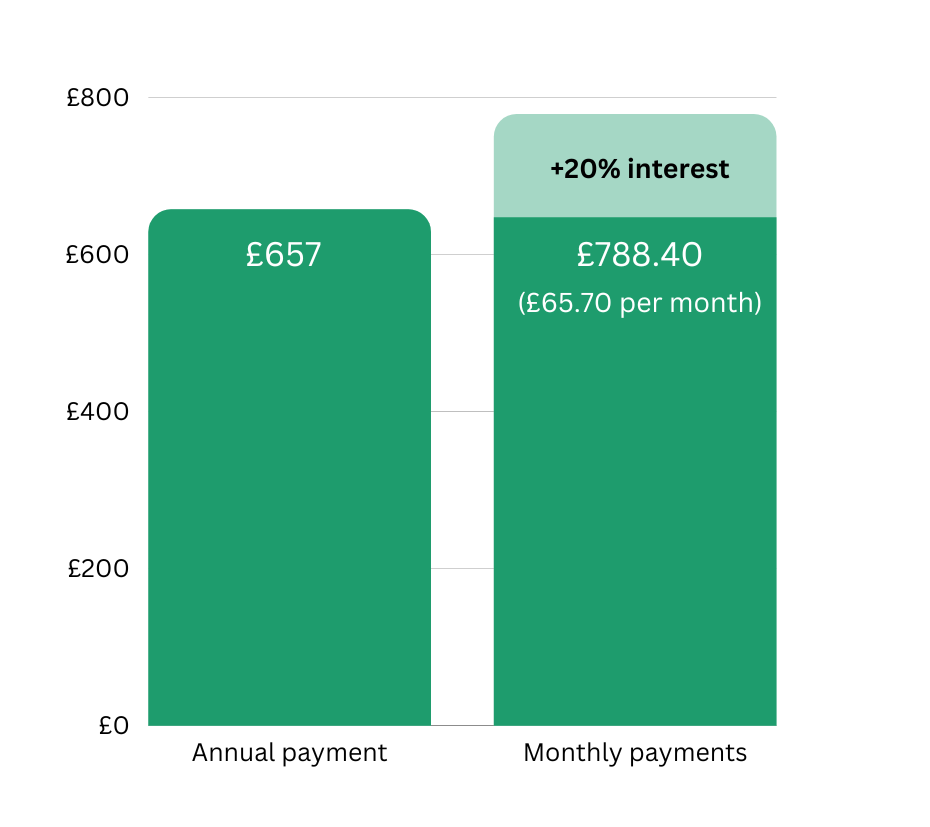

A new insurance policy can be paid upfront annually or broken up into monthly instalments. If you’re able to pay for your insurance upfront for the whole year, you’ll save yourself money.

When you agree to monthly car insurance payments, you’re entering into a finance agreement with the insurer, which means you could pay as much as 20% on top of the cost of your insurance in interest over the course of the year (Source: Uswitch).

Check out the infographic below to see how paying monthly can hike up your car insurance costs. The figures are based on the average price of car insurance during the first quarter of 2023, which was £657 per year (Source: Sky News).

Not everybody can afford to pay for their insurance in one lump sum, but there are ways around paying interest fees.

One option is to pay upfront using a 0% credit card, but you should only ever enter into a credit agreement if you’re confident you can make the minimum monthly repayments. You’ll also need to make sure the balance is completely paid off before your interest-free period is up.

11. Consider a higher voluntary excess

Excess is the amount of money you pay to an insurance provider if you make a claim on your insurance. Agreeing to a higher amount can reduce your premium, although you should only ever increase your voluntary excess to an amount you know you can afford.

Whatever figure you commit to, you will need to pay that amount in full in order to make a claim (in addition to the compulsory excess set by the insurance provider).

12. Don’t pay for optional extras you don’t need

When you’re choosing your insurance policy, try not to be swayed to add extras to your policy that you don’t actually need. Extra add-ons like courtesy cars and windscreen repairs nearly always come at an additional cost, and if you don’t actually use them, you’ll have spent unnecessary money.

However, that’s not to say you should forego extra cover that you think you need. Things like breakdown cover are essential for drivers, but you could save money by booking it separately from your car insurance policy. The same goes for any other car insurance add-on you’d like to have — check to see if you can get the same thing cheaper elsewhere.

13. Beware of administration charges

It’s important to be aware of any administration charges that might crop up during your policy period.

Our personal circumstances can change even when we’re least expecting it, and some car insurance providers will charge you to make changes to your policy details before the policy needs renewing.

For example, if you get a new car, switch jobs or move house, you could be charged £20 or more to update your policy details.

Some insurers don’t charge admin fees for these kinds of policy changes, so make sure you consider this when choosing your insurer. This also applies to cancellation fees, in the event you need to cancel your policy altogether.

Make your car more desirable to insurers

There are things you can do to lower the risk your car poses for potential insurers. Some changes are small, but there are more concrete changes you could make if you want to significantly reduce your costs (such as switching your car model and make entirely).

14. Make sure your car is secure

Your insurance policy can cover you in the event your car gets stolen, but this is sometimes only offered for drivers who take appropriate precautions to protect their vehicle in the first place.

You might even be able to lower the cost of your insurance if you have things in place to keep your car protected from theft. Security alarms, immobilisers and locks for your steering wheel and/or car tyres all have the potential to bring down the costs of car insurance premiums.

When you’re looking at quotes, it’s a good idea to check if the provider will offer you a lower price if you have certain security features installed. If the saving is bigger than the cost of installing them, it could be worth your while.

15. Think about where you park your car overnight

Leading on from the tip above, insurers want to know you’re doing everything within your power to keep your vehicle safe.

Parking your car on the road means it's out of your sight and more vulnerable to theft or vandalism. So, if you can park your car in a garage or private driveway instead of on the road or somewhere equally public, you may be able to secure a cheaper car insurance premium.

If you have no other option, park it in a well-lit area if you’re able to, as this will reduce your chances of being targeted.

16. Be aware of how modifications can increase your premium

Thinking about customising your car? Whether you’re changing the outer appearance or altering the vehicle’s performance, make sure you’re aware of how this can affect your insurance deal.

Not only will it cost you to make alterations to your car, but it can also increase how much you pay for your insurance.

If you make a modification to your vehicle that makes it a more desirable target for thieves, or even just increases its overall value, your insurance may increase in price. With that in mind, it’s important to weigh up whether such modifications are worth it financially.

17. Could you get a car that’s cheaper to insure?

The car you drive is a big deciding factor when it comes to how much you pay for your insurance. While we’re not saying you should switch your BMW for a Ford Fiesta, if you are thinking of changing your car, you might want to consider which makes and models are usually cheaper to insure.

Insurance providers rank cars by how cheap or expensive they are to insure. High-powered, desirable cars are likely to be more expensive to insure than your average hatchback. The size of the engine is another important factor; those with smaller engine capacities cost less to insure, on the whole.

Other things an insurer may consider include the car’s overall performance, security and safety features, and the average cost to repair or replace its parts.

So, if you are in the market for a new car, you might want to consider what insurance category each of the cars on your shortlist falls into.

According to Compare the Market, these were the cheapest cars to insure in 2023:

- Citroën C1 (2005–2014)

- Fiat Panda (2004–2011)

- Ford Ka+ (2016–2019)

- Hyundai i10 Premium (2014–2020)

- Kia Rio (2011–2017)

- Nissan Micra (2017–2023)

- Skoda Fabia (2015–2021)

- Vauxhall Corsa (2006–2014)

- Volkswagen Polo (2017–2023)

- Volkswagen Up! Move Up (2012-2023)

How to lower your risk as a driver in the eyes of an insurer

There are plenty of things you can do to make yourself more appealing to an insurer, and therefore get a cheaper car insurance quote.

Some tips in this section require you to actually change your behaviour (e.g. drive fewer miles) or take extra security precautions (like getting a dashcam). Other tips suggest things you can tweak slightly on your quote, without having to make any actual changes.

Bear in mind that making too many tweaks to your search can be a hindrance rather than a help, as insurers may hike up prices if they think you’re trying to manipulate your quote.

18. Consider getting a dashcam

Some insurance providers offer cheaper premiums for drivers who have dashcams installed in their cars.

Declaring you have a dashcam suggests to a potential insurer that you’re a responsible driver who is happy to have their actions on the road recorded and potentially examined. As a result, you might be offered a more affordable premium.

Even if you’re not offered a cheaper rate, a dashcam is still a sensible thing to invest in. They record what happens in and around your car, which can be very useful if you need to prove who’s at fault after an accident.

19. Carefully consider how you describe your job

Some professions require you to spend more time driving on the road than others. Because of this, insurers will categorise professions according to how high-risk they are.

This means you may be able to adjust your job title slightly to see if it brings down the cost of your premium. While you can't choose any job title you like, you might find there are several different job titles that describe your occupation fairly. Some of these titles might bring up cheaper quotes than others, so it’s worth trying more than one.

Bear in mind that if you inaccurately describe your job, you could be invalidating your insurance. In extreme cases, this can result in prosecution for insurance fraud. You’ll also need to be careful not to try too many varying job titles (no matter how slight the differences are) as some providers may increase your premium price if you do too many searches.

Good to know...

If your profession disadvantages you when it comes to the price of your car insurance, it’s worth speaking to your professional association or trade union if applicable, as there may be things in place to counter this disadvantage.

20. Add another named driver to your policy

High-risk drivers (including drivers under 25, new drivers, older people, and drivers with previous insurance claims or driving convictions) are likely to have higher premiums than lower-risk drivers.

So, if you fit into any higher-risk categories, one way to reduce your costs is to add another named driver. Adding a more experienced driver or a driver with a low-risk profession could potentially bring down the cost of your premium.

If you have someone in your family who is likely to drive your car at some point (such as a partner or family member), try adding them as a named driver onto a quote. On the flip side, don’t forget that adding another driver who is deemed higher risk will probably increase the cost of your policy.

It’s important to stress that your named driver has to be someone who is actually likely to drive the car, and you can’t claim someone else to be the main driver of the car if they’re not (this could invalidate your policy and even lead to a criminal conviction).

21. Build up your no-claims

The longer you go without making a claim on your car insurance, the bigger your no-claims bonus will be when it’s time to renew your policy. If you can avoid making a claim on your insurance for eight years or more, you could save up to 80% on your insurance (Source: Uswitch).

However, if you do get into an accident in your vehicle, no matter how small, you need to inform your insurance provider as soon as possible. This is true even if you’re covering the cost of the damage yourself.

You may also be able to pay an extra fee in order to protect your no-claims, known as no-claims discount protection. This means you can make a claim on your insurance without losing the no-claims bonus you’ve built up.

You’ll probably have a limit for how many claims you can make within a certain time period, so make sure you check with your insurer to see how their policies work.

22. Reduce how much you drive

Generally speaking, if you drive fewer miles, your premium should be cheaper. This is because people who drive their cars more frequently have a higher likelihood of getting into an accident at some point down the line.

Insurers use average miles as one of the main deciding factors for calculating premiums, which means you could unlock a cheaper deal if you’re able to limit how many miles you drive in a year.

With that said, you need to be honest about how many miles you realistically drive in an average year. If you’re not truthful, this could result in claims not being paid out.

There are two ways to work out your average annual mileage. Firstly, you could calculate an average of your mileage from previous years by looking at your MOT certificates. Alternatively, you can track how many miles you drive each week and multiply that by 52 for an annual estimate.

What you use your vehicle for is another important factor here. If you use your car for business and opt to add business-use cover, this might make your premium pricier. So, if you’re able to stick to using your car for personal use only, you can avoid paying this extra expense.

23. Make sure you’re on the electoral roll

Insurers may struggle to confirm your identity if you’re not on the electoral roll.

As a result, if you’re not on the electoral register, you may find the quotes you’re offered are more expensive than you expected. In some cases, depending on the provider, you may be denied cover entirely.

24. Don’t get stung with penalty points

It should be pretty clear by now that, as a general rule, more responsible drivers will be able to take advantage of cheaper cover. Insurers save their best deals for drivers who can be trusted to drive safely because these drivers are less likely to make a claim.

You’ll generally be offered cheaper car insurance premiums if you have a clean driving license with minimal penalty points (ideally none at all). This means you always need to be careful to avoid speeding, using a mobile phone while driving, and driving recklessly (as this could lead to road accidents). In essence, be the best driver you can and you’ll be rewarded when it comes to renewing your premium.

25. Take an advanced driving course

Advanced driving courses are a great way to improve your driving and potentially bring down your premium too. These courses are particularly helpful for new drivers or anyone who’s slightly nervous while on the road, as they help instil confidence.

It varies between providers whether discounts are offered for those with extra driving qualifications, so have a look to see if it’s worth doing before you commit. Will the price of the course be outweighed by the discount you’ll receive? If the answer is yes, then it’s worth a shot.

And if you feel like taking one of these courses would make you a happier, more confident driver, that’s probably reason enough.

Let’s get this show on the road…

If you take all of the things in this guide into consideration, we’re confident at least a few of them will help you reduce the price you pay for your car insurance.

Whether it’s making yourself look desirable to insurers or switching your policy type to better suit your driving habits, there’s no reason why your premium should cost the earth.

Keep in mind that it’s illegal to lie, exaggerate or underplay any personal or driving characteristics that might affect your quote. For example, if you’re a delivery driver, you can’t say you’re a journalist, and if your partner never drives your car, you shouldn’t add them to your car’s policy.

But as long as you remain honest and upfront, you should still be able to tweak some aspects in order to get a more affordable quote.

Have you used any of the tips in this guide to get a better deal on your car insurance? Let us know in the comments how much you saved.

The information contained within this article is for editorial purposes only and is a general guide and description of the products listed above. Nothing in this article should be relied on as financial advice.

There may be other products available not listed in this article which may be more suitable for your personal needs.