The information in this article has been sourced from information available in the public domain. You should take independent financial advice before entering into a mortgage or other investment product.

If you’re buying your first home, you’ll need to get to grips with the rules for first time buyer stamp duty. But don’t worry, it might not be as complicated as you think.

In this guide to stamp duty for first time buyers, we’ll answer all the burning questions, from how to calculate stamp duty to how to pay it. We’ve also included lots of other useful information about why you have to pay tax on your home in the first place, and how the rates vary between England, Scotland, Northern Ireland and Wales.

But we’ll put you out of your misery and give you the good news first: if you’re buying a property priced under £425,000 in England or Northern Ireland and you’ve never previously owned a property before (i.e. you’re a first time buyer), you don’t have to pay stamp duty.

Now, onto the nitty gritty…

What is stamp duty?

Stamp Duty Land Tax (SDLT) is a type of tax that you have to pay when you buy a residential property in England or Northern Ireland. This tax is only paid if the property you’re buying is over a certain price and it’s taken as a one-off payment.

Although standard stamp duty rates have increased quite dramatically over the past 10 years, the rates of stamp duty for first time buyers have become a lot more generous.

In 2024, with soaring house prices and an ongoing cost of living crisis, there is currently stamp duty relief for first time buyers. This relief means that first time buyers purchasing a property in England or Northern Ireland that’s worth less than £425,000 don’t have to pay any of this tax.

Did you know?

Stamp duty was first introduced in England in 1694 as a transaction tax to raise money for a war against France.

Do first time buyers pay stamp duty?

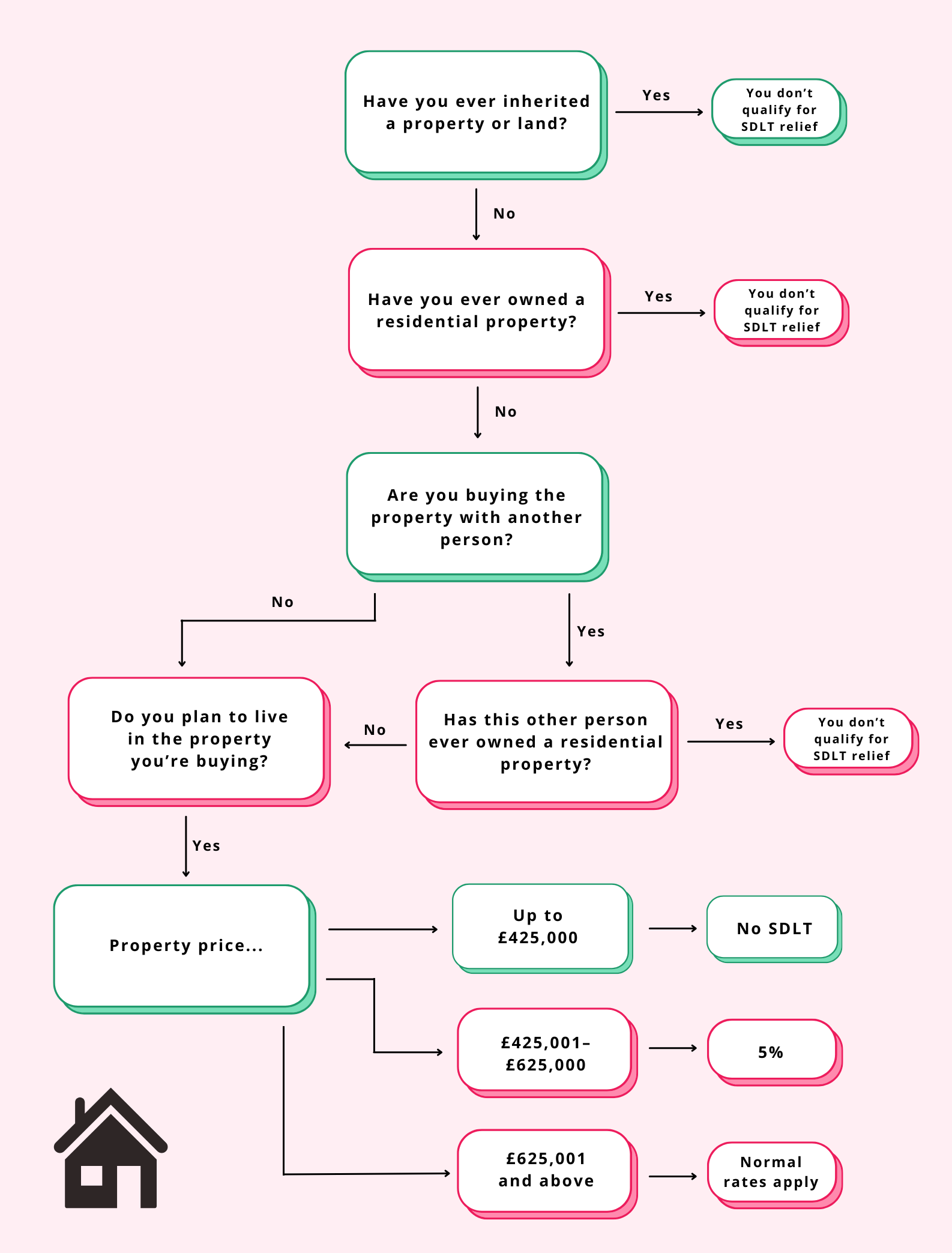

If you’re looking to buy your first home, you may be exempt from paying stamp duty. You qualify as a first time buyer if:

- You have never owned a residential property in the UK or abroad

- You plan to live in the property you’re going to buy

- You’ve never inherited a property or land

So, what is first time buyer stamp duty relief and how do these rates differ from the standard rates? The below figures show the current stamp duty rates for first time buyers in England and Northern Ireland:

House price | Stamp duty rate |

|---|---|

Up to £425,000 | 0% |

£425,001–£625,000 | 5% |

As you can see from the figures above, at the time of writing, first time buyers in England and Northern Ireland don’t pay any stamp duty on a property purchased for less than £425,000.

However, if your first home costs more than this, you will pay a percentage of the property value in the form of SDLT.

We’ll give you some examples to help you make sense of how it works…

If you’re buying a house priced between £425,001 and £625,000, you’ll pay 5% tax on the amount over £425,000.

So, if you’re buying a house for £450,000, you’ll pay 5% of £25,000 (the difference between £425,000 and £450,000). This works out to be £1,250. Similarly, if the house price is £600,000, you’ll pay 5% of £175,000, which is £8,750.

Remember this is paid in a single, one-off payment when you first buy your property.

If your first home is over £625,000, you won’t be eligible for first time buyer relief. This means the standard stamp duty rates (the stamp duty rates for non-first time buyers) apply, which are outlined below:

House price | Stamp duty rate |

|---|---|

Up to £250,000 | 0% |

£250,001–£925,000 | 5%* |

£925,001–£1.5 million | 10% |

£1.5 million & up | 12% |

* Keep in mind that if you’re a first time buyer, you’ll only revert to the standard rates if the house you’re buying is over £625,000.

This means you should ignore the first row of the table and start from the highlighted row. If the property you’re buying is over £625,000 (but less than £925,000), you’ll fall under this bracket.

It can be confusing, but the main thing to remember is this: as a first time buyer, you only pay stamp duty on the amount of the house price that is above £425,000.

Here's a flow chart to help you work out whether you'll qualify for SDLT relief:

In November 2023, the average house price in the UK was £284,950, which means many first time buyers won’t have to worry about paying any stamp duty at all.

However, this depends on where you live. The average house price in November 2023 for London was £505,283, while the average price in North West England was £213,333.

Location | Average price |

|---|---|

London | £505,283 |

England | £301,613 |

Wales | £212,866 |

Scotland | £194,006 |

Northern Ireland | £179,530 |

The rules for stamp duty are the same for everyone living in England and Northern Ireland, regardless of the average house prices in your specific region.

So, if you live somewhere that has particularly high average house prices, you might want to bear this in mind while searching for your first home.

How to apply for a first time buyer stamp duty exemption

If you’re a first time buyer purchasing a property with a value of under £425,000, your conveyancing solicitor will be responsible for ensuring you meet the criteria.

This will form part of the usual checks your solicitor will do to confirm your identity, address and affordability.

Your solicitor will most likely send you an SDLT form to sign, where you’ll need to confirm the property price and your position as a first time buyer.

By signing this document, you’ll be confirming your intentions to live in the property as your primary residence, that you’re buying the property as individuals (not a business), and that you’ve never owned any property before.

If you’re buying the property with somebody else, you’ll both need to declare and sign this form.

Do both people need to be first time buyers in order to apply for stamp duty relief?

Yes, you must both be first time buyers to benefit from the stamp duty relief scheme. If one of you has owned a property before, you’ll both be treated as regular buyers.

First time buyer stamp duty in Scotland and Wales

Stamp duty in Scotland and Wales works in the same way as the rest of the UK, although the rates are different.

Scotland: Land and Buildings Transaction Tax (LBTT)

In Scotland, stamp duty is known as Land and Buildings Transaction Tax (LBTT).

Land and Buildings Transaction Tax rates for first time buyers in Scotland work as follows:

House price | Stamp duty rate |

|---|---|

Up to £175,000 | 0% |

£175,001–£250,000 | 2% |

£250,001–£325,000 | 5% |

£325,001–£750,000 | 10% |

£750,001 & up | 12% |

So, if you’re a first time buyer purchasing a property in Scotland worth less than £175,000, you won’t pay any stamp duty.

If the property price is between £175,001 and £250,000, just like we explained earlier, you’ll pay stamp duty on the amount above £175,000. This means that if you’re buying a £240,000 house, you’ll pay 2% stamp duty on £65,000, which equates to £1,300.

If you buy a house in Scotland for £300,000, you’ll pay 2% stamp duty on the portion of the house price between £175,001 and £250,000 and 5% on the portion over £250,001. This equates to £1,500 and £2,500 respectively. So, in total, your stamp duty will cost you £4,000.

Wales: Land Transaction Tax (LTT).

In Wales, stamp duty is known as Land Transaction Tax (LTT).

Unfortunately for anyone buying a house In Wales, there are no first time buyer exemptions when it comes to LTT. Anyone buying a property in Wales will have to adhere to the standard rates, outlined in the table below.

With the average house price in Wales at £212,866, it’s likely you will pay at least some stamp duty if you’re buying a house in Wales.

House price | Stamp duty rate |

|---|---|

Up to £180,000 | 0% |

£180,001–£250,000 | 3.5% |

£250,001–£400,000 | 5% |

£400,001–£750,000 | 7.5% |

£750,001–£1.5 million | 10% |

£1.5 million & up | 12% |

Stamp duty FAQs

If you’ve still got questions about how stamp duty works, check out these FAQs:

Q: Are first time buyers stamp duty exempt?

A: No, first time buyers aren’t entirely exempt from paying stamp duty, although the house price thresholds are higher for first time buyers in England, Northern Ireland and Scotland.

This means you’ll pay tax on a smaller portion of your property’s value than someone who isn’t a first time buyer.

Q: How do you pay stamp duty?

A: If you don’t qualify for a stamp duty exemption, you’ll need to pay the amount you owe in one lump sum on the day you complete your house purchase, or within 14 days after that.

Your conveyancing solicitor will usually file your stamp duty tax return to HMRC on your behalf.

Q: Do my partner and I both need to be first time buyers to benefit from the stamp duty relief scheme?

A: Yes, if you’re buying as a couple, you’ll only qualify for first time buyer stamp duty relief if you’re both first time buyers.

This means neither of you can have ever owned a residential property in the UK or abroad, or inherited property or land. You must both also be planning to live in the property you’re going to buy.

Unfortunately, if one of you has bought a property before, you will both be treated as regular buyers.

Q: When did first time buyer stamp duty relief start?

A: Stamp duty relief for first time buyers was originally introduced in England and Northern Ireland in November 2017, as a means of helping people get onto the property ladder. The thresholds were increased in September 2022.

Q: When does first time buyer stamp duty relief end?

A: The current first time buyer stamp duty relief scheme will stay in place until March 2025, at which point the minimum threshold will revert from £425,000 to £300,000.

Q: Are there other ways to pay less stamp duty?

A: If you’re able to haggle on the price of the property you’re buying, whether it’s an older house or a new-build, you may be able to reduce the amount of stamp duty you pay.

Q: Can stamp duty be included in my mortgage?

A: Yes, adding stamp duty onto your mortgage is possible, but there are no specific schemes allowing buyers to do this.

The only way to add stamp duty to your mortgage is to increase the size of your mortgage to include the cost of your stamp duty. Borrowing more money will impact you in two very significant ways.

Firstly, a larger mortgage will mean you pay more interest over your mortgage term, meaning it’ll cost you more over the years than it would if you paid your stamp duty upfront.

Secondly, borrowing more will affect your loan-to-value (LTV) ratio, which may result in higher mortgage rates and even a smaller choice of lenders.

You also need to consider whether you’d get approved for this larger mortgage amount. If you don’t meet a lender’s affordability requirements for the higher amount, you won’t be able to add the cost of your stamp duty to your mortgage.

Q: Can first time buyer stamp duty be refunded?

A: It’s very unlikely as a first time buyer that you would find yourself in a position to need to claim a refund on your stamp duty.

However, if you do think you’ve paid too much stamp duty, you may be entitled to a refund. You can get more information about this on the HMRC website.

If you’re buying an additional home, you may be able to apply for a refund on the second home 3% stamp duty surcharge if you sell your primary residence within three years.

Q: Are there consequences for late or non-payment?

A: Yes. Homebuyers are typically given 14 days to file their stamp duty tax return and pay the amount they owe.

It is illegal to not pay the stamp duty you owe, and there are sometimes penalties and added interest for people who miss their payment deadline.

Q: What if I’m buying my first property but plan to rent it out?

A: There are different rules for first time buyers when it comes to buy-to-let stamp duty.

If you’re buying your first property and intend to use it as a rental property rather than live in it yourself, you won’t qualify for first time buyer stamp duty tax relief. This means the standard stamp duty rates will apply.

It’s also worth noting that anyone buying an additional property to their primary residence with the intention to rent it out will pay a minimum 3% stamp duty surcharge.

Q: Are there any other costs of buying a house I need to consider?

A: Yes, there are lots of different costs involved when you buy your first home, which will all need to be factored into your personal budget.

Here are some of the things to bear in mind when working out your affordability, although this isn’t an exhaustive list and each person will have different considerations to make.

We’ve included some general price information based on UK averages at the time of writing for your reference. You may find that you pay less or more than the prices we’ve outlined.

- Legal fees: between £1,500 and £2,500

- House survey (for older houses): between £300 and £1,500

- Snagging survey (optional, for new builds): between £300 and £600

- Building and contents insurance

- Life insurance

- Removal van hire

- If you’re buying a new build, you may need to pay additional fees for things like flooring, garden turfing and kitchen appliances

- Any costs associated with furnishing and decorating your home

It's time to get those house viewings booked...

We hope this first time buyer guide to stamp duty has helped you to feel more confident about buying your first home. Here’s a quick round-up of some of the key points to keep in mind.

- If you’re buying a property in England or Northern Ireland, you’ll be exempt from paying stamp duty as a first time buyer if the property price is under £425,000.

- If you’re buying your first home in Scotland, you’ll pay stamp duty on anything above £175,000.

- First time buyers in Wales aren’t entitled to any stamp duty relief, so will pay stamp duty on anything above £180,000.

When you buy your first home, it’s important to seek out professional advice to help you make informed decisions.

An independent financial adviser or mortgage broker can give you impartial advice and help you make sense of the costs, while your conveyancing solicitor can give you more information about the projected costs of searches and checks.

When finding financial and legal professionals to work on your behalf, it’s good to go with people who have been recommended by someone you trust. If you’ve got friends or family members who are homeowners, you could ask them whether they’d recommend their mortgage broker and/or solicitor to you.

And lastly, if you are paying stamp duty, it’s important to factor the price of this into your overall house budget, as the costs can quickly add up.

If you're in need helping finding independent financial advice, Citizens Advice can help.

The information in this article has been sourced from information available in the public domain. You should take independent financial advice before entering into a mortgage or other investment product.