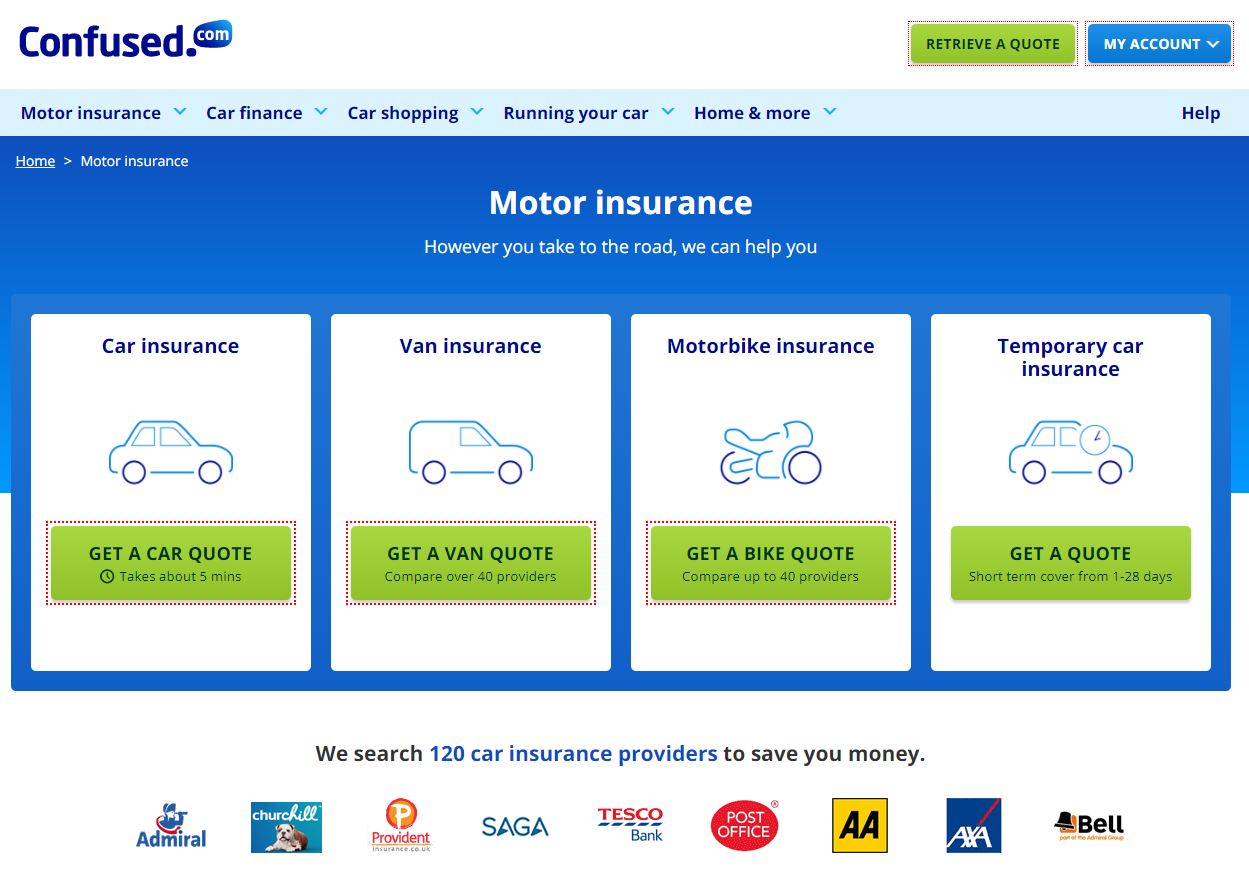

Get a Confused.com Motor Insurance quote in around five minutes on the free and easy to use insurance comparison site and see how much you could save. Just enter details of your vehicle, including the registration, no claims bonus, any other drivers, your driving licence and any convictions, as well as previous claims and accidents, and they’ll search more than 100 car insurance providers, including insurance company heavyweights like Tesco Bank, Admiral and AXA, to get you the best cover at the best price.

Once you’ve got your quote, it will be possible to include a range of add-ons or extras, such as legal cover, breakdown cover, a courtesy car and windscreen cover. You'll also find handy tools, such as the price index, and saving tips on their site.

You can also download their app for mobile phones. Take a look at the Confused.com special offers available, but whatever your quote, you’ll be able to save money on your car or van insurance thanks to our Confused.com Car Insurance discount code and cashback deals.

Available Insurance Policies

If you're looking for car insurance, you can choose comprehensive, third party only or third party, fire and theft cover, while they can also provide you with cheap car insurance quotes for multi-car, black box and temporary insurance, as well as cover if you use your vehicle for business, are a learner or have a classic car.

They’ll show you the cheapest annual and monthly prices, while the different levels of cover will also be clearly displayed. Sign up to TopCashback, meanwhile, and you can claim cashback or perhaps benefit from Confused.com promo codes when you get a new, genuine quote at Confused.com UK for an even better insurance deal.

As well as car insurance, you can also get a quote for motorbike insurance, van insurance, caravan and motorhome insurance, gap insurance and motor excess insurance, plus motor trade and fleet insurance.